It's been the biggest renovation boom in decades, but it's winding down

This article was originally prepared by Auckland based reporter Miriam Bell, and printed in Stuff. You can find it here.

Home improvement work nationwide hit record highs last year as property owners unable to travel spent up large on renovations, new analysis shows.

The value of consents for total alterations and additions to existing homes was $1.8 billion over the nine months ending September last year, according to Ray White chief economist Nerida Conisbee.

Her analysis, which used Stats NZ figures going back to 1991, showed this amount was unprecedented over the period analysed.

The amount spent was highest in the Auckland region at $640 million. It was followed by Wellington at $111.6 million, and then Christchurch at $95.5 million.

But Infometrics principal economist Brad Olsen said the figures were even higher.

He analysed the Stats NZ figures for all residential dwellings for the entire 2021 calendar year, and it showed there was a “whopping” $2.4b in alterations and additions consented. That was a 24 per cent increase on 2020.

Auckland, with its higher level of denser dwellings, also had a substantially higher figure of $866m in total alterations and additions for all residential dwellings over the entire 2021 year.

Conisbee said very low interest rates and high savings rates were the key drivers of this renovation activity, as they were for house price increases.

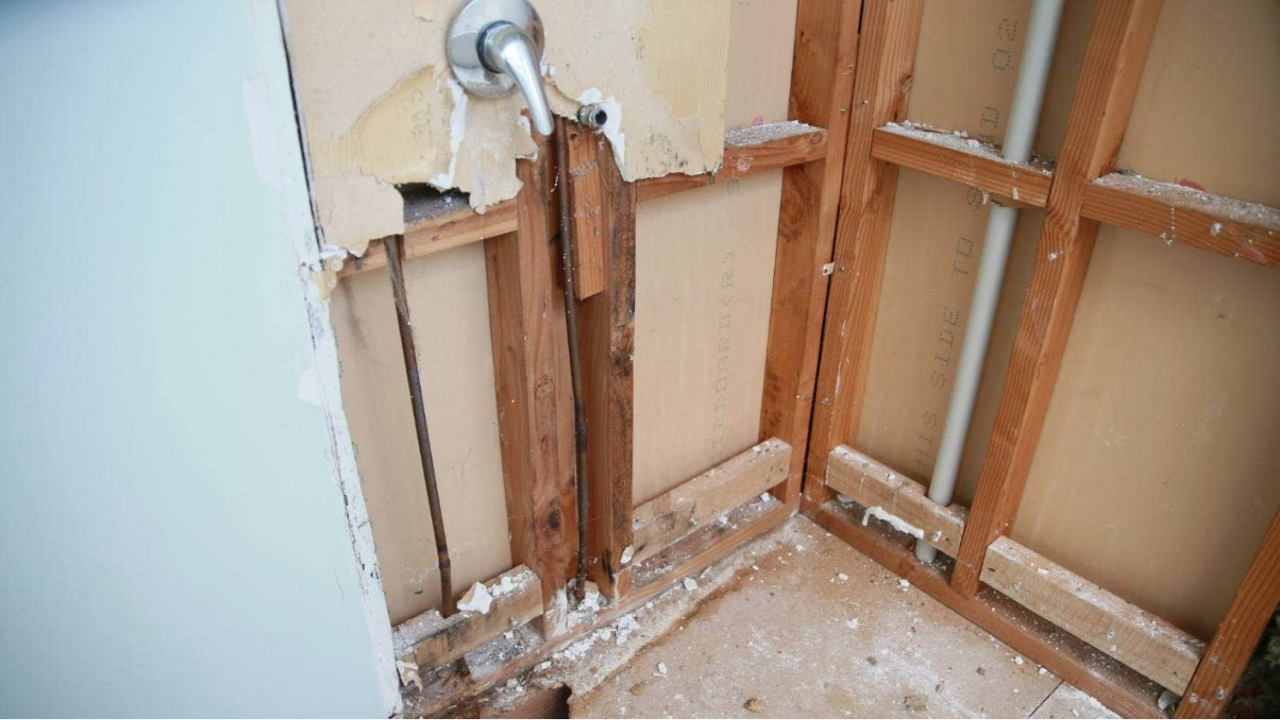

“Add to this, a lot of time stuck at home due to the pandemic, and the result is a lot of much nicer kitchens, new bathrooms and beautiful outdoor areas.”

Her analysis showed Aucklanders spent the most, with the average renovation spend approved in the region at $126,000.

Queenstown-Lakes District was second at $116,000, and Wellington third at $106,000, while the Christchurch average was lower at $57,322.

Conisbee said the Auckland spend was largely due to the region’s higher prices. “They put people off moving, and make it harder to overcapitalise.

“But the region’s longer lockdowns would play a role too, as people stuck at home need more space, particularly if they are working or studying.”

Builderscrack spokesman Jeremy Gray said activity on their platform corroborated the huge size of the renovation boom.

“It’s not just that we have had a record number of jobs posted outright, but that the average value of the jobs are higher.

“This indicates more sophisticated and intensive work is being required, rather than standard repairs and maintenance work.”

Supply chain issues and labour shortages mean building costs have been climbing, and Gray said it was inevitable that would begin to erode people’s willingness to spend up on relatively small home improvements.

Conisbee and Olsen agreed renovation activity was unlikely to continue at the same rate, with higher building costs a contributing factor.

But Olsen said the boom had been driven by households’ ability to finance renovation work at cheaper rates which allowed them to borrow more, and that situation had changed.

Interest rates were on the rise, and new rules under the Credit Contracts and Consumer Finance Act meant the lending environment had become tougher.

With finance no longer as cheap or as accessible, and the prospect of building costs blowing out due to supply chain issues, many households would be assessing whether renovation work was necessary, he said.

“If household budgets are starting to get more stretched, people are likely to put home improvements on hold, unless they are critical. So the boom is likely to ease off considerably over the coming year.”

Renovation expert Jen Jones, from Nine Yards Consulting, said rising costs and supply issues were starting to put some sectors of the market off.

Over the last few years, she has worked with clients across all spending levels, from smaller budget DIY-ers to ultra high spenders. But the DIYers were pulling back because prices were too high, she said.

“Those at the high end of the market will keep spending, but overall there is a bit less demand than there was. Still, the main issue is that supply has declined and that is causing problems.”

The lead times being quoted for delivery of materials were often unreliable, she said.

“It is a good time to be a supplier if you manufacture your product domestically, as renovators are having to turn to local brands which may not have been their first choice previously. But they are now feeling the pressure too.”

It was not a good idea for would-be renovators to hold off on work because they hoped costs would fall, Jones said. “They might stagnate, or even drop a little, but there is not going to be a significant decline in prices.”